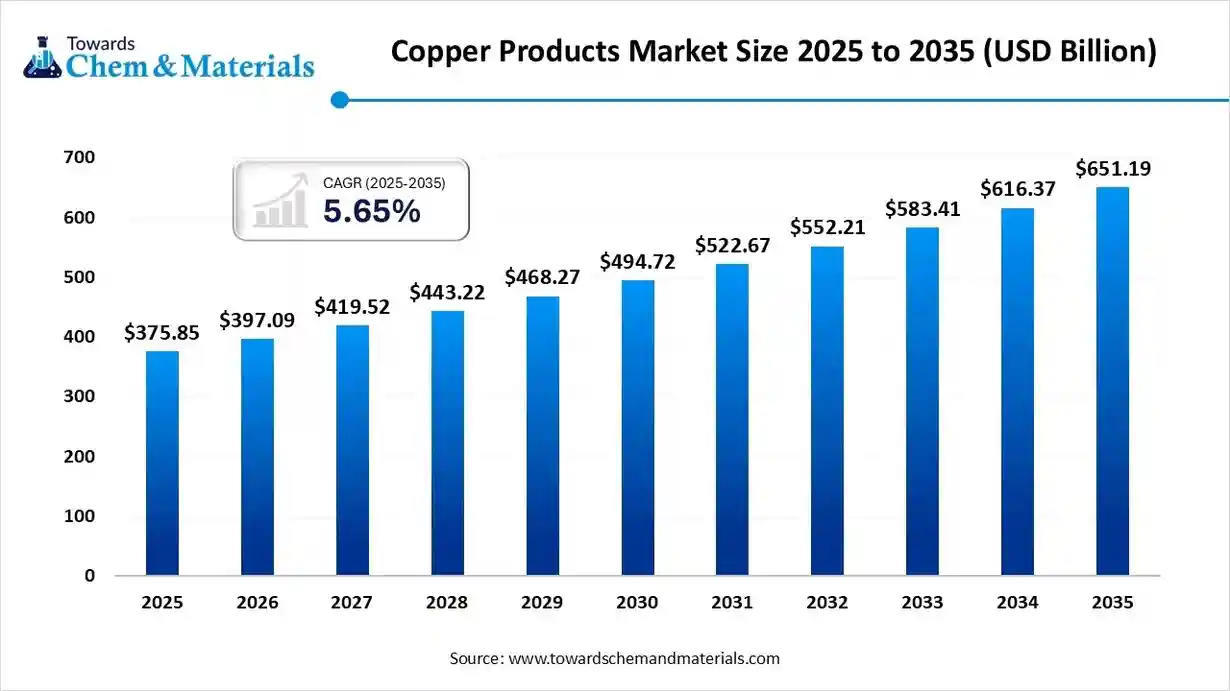

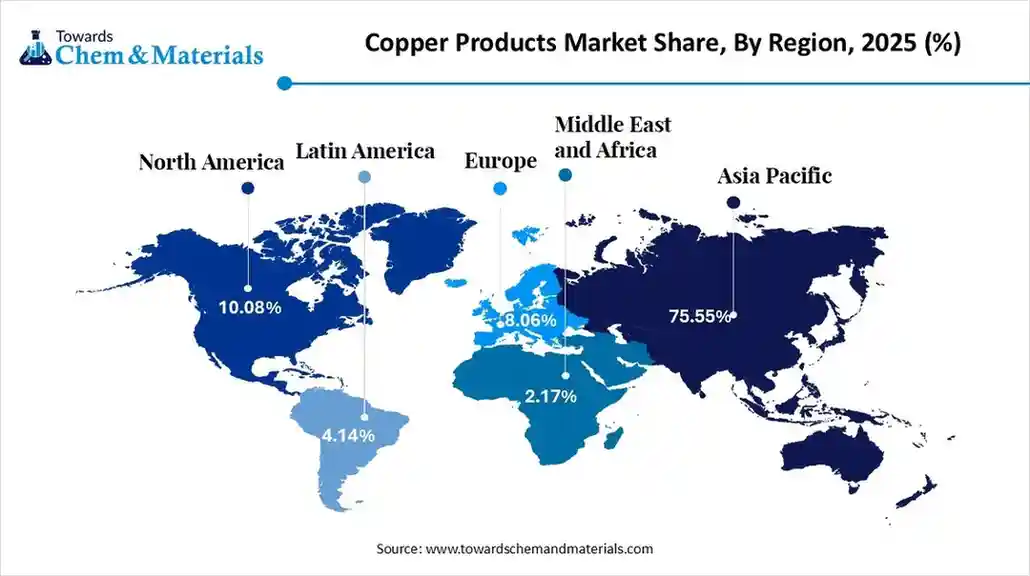

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The global copper products market size was valued at USD 375.85 billion in 2025. the market is projected to grow from USD 397.09 billion in 2026 to USD 651.19 billion by 2035 at a CAGR of 5.65% during the forecast period. Asia Pacific dominated the copper products market with a market share of 75.55 % in 2025. Rising demand for copper in renewable energy systems such as solar panels and wind turbines is a key growth factor driving the expansion of the copper products market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6034

What are Copper Products?

The global copper products market remains dominated by the Asia Pacific region, where demand from electrification, electronics manufacturing, and rapid infrastructure expansion drives bulk consumption. The “primary copper” category remains the backbone of the market thanks to its established use in high-conductivity applications across wiring, industrial components, and construction systems.

In terms of product type, copper wire is the mainstay; its electrical and thermal conductivity keep it essential for power transmission, electronics, renewable energy installations, and wiring across sectors. On the end-use side, the building and construction sector continues to absorb a large portion of copper demand, driven by wiring, plumbing, HVAC, and architectural needs in expanding urban environments. At the same time, segments such as recycled/ “secondary copper,” flat-rolled copper products, and infrastructure-related end uses are gaining traction, reflecting rising interest in sustainability, modern electronics, and large-scale infrastructure development.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Copper Products Market Report Highlights

- Asia Pacific dominated the global copper products market with the largest revenue share of 75.55% in 2025.

- The China copper products market is projected to grow during the forecast period.

- By type, the primary copper segment accounted for the largest revenue share of 84.8% in 2025.

- By product, the wire segment dominated with the largest revenue share of 61.7% in 2025.

- By end use, the building and construction segment dominated with the largest revenue share of 28.4% in 2025.

- Major market players have adopted organic and inorganic strategies, including acquisitions and product launches. For instance, Mueller Industries acquired Elkhart Products Corporation (EPC), a US-based manufacturer of copper solder fittings, with manufacturing facilities in Elkhart, Indiana, and Fayetteville, Arkansas.

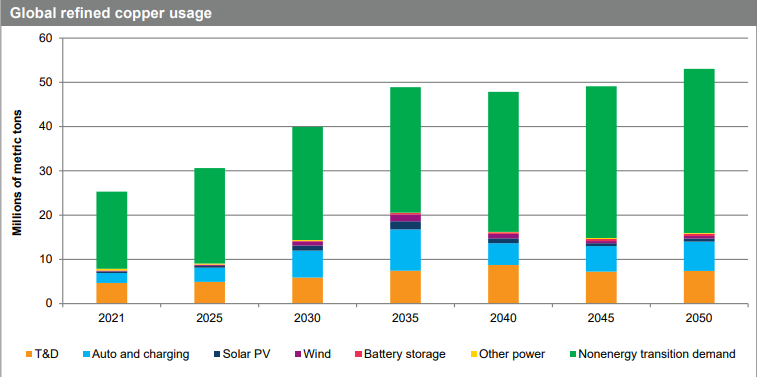

This study finds that copper demand from the energy transition will accelerate steeply through 2035. Crucially, this dramatic escalation occurs well before 2050 while traditional growth continues to ramp up. The conclusion: achieving the stated climate ambitions will require a rapid and massive ramp-up of copper supply far greater than is visible in any private or public plan.

This energy transition demand growth will be particularly pronounced in the United States, China, and Europe. India will also exhibit strong copper demand growth, albeit more so from traditional copper applications. The High Ambition Scenario assumes that ramped-up demand growth will coincide with record-high rates of copper mine capacity utilization and recycling, but even these aggregated improvements will be insufficient to close the gap. In the Rocky Road Scenario, the shortfall will be much greater, and sooner.

The initial increase in demand over the coming decade will be particularly challenging. Global refined copper demand is projected to almost double from just over 25 MMt in 2021 to nearly 49 MMt in 2035, with energy transition technologies accounting for about half of the growth in demand. The world has never produced anywhere close to this much copper in such a short time frame.

Demand from nonenergy transition end markets—such as building construction, appliances, electrical equipment, and brass hardware and cell phones, as well as expanding applications in communications, data processing, and storage—is also expected to continue to grow, rising at a compounded annual rate of 2.6% between 2020 and 2050. Altogether, total refined copper demand is expected to reach approximately 53 MMt in 2050. It is important to note that copper demand would see significant increases over the projection period even in a world that did not fully transition to net zero. Copper demand from energy transition end markets is expected to reach a maximum of almost 21 MMt in 2035. This surge in demand to meet Net-Zero Emissions by

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6034

Copper Products Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 397.09 Billion |

| Revenue forecast in 2035 | USD 651.19 Billion |

| Growth rate | CAGR of 5.65% from 2026 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2018 - 2023 |

| Forecast period | 2026 - 2035 |

| Quantitative Units | Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | Type, product, end use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE |

| Key companies profiled | Jiangxi Copper Corporation; Aurubis AG; Codelco; Glencore; BHP; AngloAmerican; Teck Resources Limited; Antofagasta plc.; KGHM; Rio Tinto; Freeport-McMoRan; GRUPO MÉXICO |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments in Copper Products:

- Aurubis AG: This German company is a global provider of non-ferrous metals and one of the world's largest copper recyclers, producing copper cathodes, wire rods, and other products.

- Wieland Group: Headquartered in Germany, Wieland is a major private investor focused on manufacturing a wide range of high-quality copper and copper-alloy products, especially copper tubes for plumbing and HVAC.

- KME Group SpA: An Italian-based metallurgical leader, KME invests in producing and distributing copper and copper-alloy products, including tubes, sheets, and wires for industries like electronics and transportation.

- Hailiang Group: This prominent Chinese group produces and invests in a variety of copper and copper-alloy tubes, pipes, and other products for applications in HVAC, plumbing, and automotive sectors.

- Jiangxi Copper Co., Ltd.: Recognized as China's largest integrated copper producer, this company invests across the entire copper value chain, spanning mining, smelting, processing, and the production of copper wires, rods, and pipes.

What Are the Major Trends in The Copper Products Market?

- A strong shift toward electrification and decarbonisation is boosting demand, as copper becomes essential for renewable energy systems, electric vehicles, and the modernisation of power grids.

- Rapid urbanisation and infrastructure development worldwide are driving growth, as expanding construction, smart-city projects, and infrastructure buildouts increase the need for copper wiring, pipes, and structural components.

- Increasing emphasis on recycling and sustainability encourages the use of recycled (“secondary”) copper, helping reduce reliance on mined ore while supporting circular economy goals.

- Advances in technology and new applications such as high-performance electronics, data centres, EV charging infrastructure, and heat management systems are driving demand for specialised copper products like foils, strips, and precision rolled materials.

How Does AI Influence the Growth of the Copper Products Industry in 2025?

The surge in AI particularly the rapid build out of AI optimized data centres and high performance computing facilities is creating a fresh, robust demand channel for copper, because AI data centres require extensive copper for power distribution, electrical wiring, cooling systems, circuits boards and connectivity infrastructure, as AI workloads push facilities to much higher power densities and energy use, copper’s electrical conductivity and reliability make it indispensable in supporting that growth.

Market Opportunity

Could The AI Data Centre Boom Unlock Fresh Demand for Copper?

As companies build more AI powered data centres, the need for copper for power distribution, cooling systems, and connectivity infrastructure increases sharply. These facilities push copper beyond traditional uses, creating a new growth channel for copper suppliers and recyclers.

Could The Global Shift Toward Electrification and Clean Energy Deepen Copper Demand Long Term?

Widespread adoption of electric vehicles, renewable energy installation, and upgraded power grids is boosting consumption of copper across multiple sectors. This structural transition offers stable demand prospects for copper producers and challenges the supply chain to keep up.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6034

Copper Products Market Segmentation Insights

Type Insights:

Why did the Primary Copper segment dominate the Copper Products Market?

The primary copper segment dominated the market, due to its extensive use in high-performance applications requiring superior electrical and thermal conductivity. This segment remains essential for power transmission systems, industrial machinery, construction wiring, and manufacturing processes where purity and efficiency are critical. Its strong presence is supported by continuous demand from expanding urban infrastructure, electrical networks, and large-scale industrial operations that rely on stable and consistent copper quality for long-term performance.

The secondary copper segment is expected to grow at a fastest rate, recycling initiatives, and circular economy models gain widespread acceptance. Increasing environmental awareness and the push to reduce dependence on newly mined copper are encouraging industries to adopt recycled copper for applications in construction, electronics, and power systems. This trend is further strengthened by cost efficiency and government policies promoting resource conservation and waste reduction.

Product Insights:

Which Product Segment Held the Dominating Share of the Copper Products Market in 2024?

The wire segment held the dominating market share in 2024, power distribution, telecommunications, and renewable energy installation. Copper wire is preferred for its high conductivity, durability, and reliability, making it indispensable in building wiring, transmission networks, and electronic assemblies. Its continued dominance is supported by expanding construction activities and the growing need for efficient energy transmission systems.

The flat rolled products segment is projected to expand rapidly as demand rises for precision components used in electronics, heat exchangers, and advanced industrial applications. These products are gaining attention for their flexibility, uniform thickness, and suitability for modern manufacturing processes. Increased usage of renewable energy systems and high-tech equipment further strengthens their growth outlook.

End-use Insights:

Why the Building and Construction Segment Dominated the Copper Products Market?

The building and construction segment dominated the market in 2024, supported by consistent demand for copper in plumbing, roofing, HVAC systems, and electrical installations. The rise in residential and commercial construction, along with infrastructure developments in urban areas, continues to drive the use of copper products for long-lasting and safe building solutions. Its importance remains rooted in copper’s durability, corrosion resistance, and efficiency in energy distribution systems.

The infrastructure segment is projected to expand rapidly as investments increase in smart cities, power grid upgrades, renewable energy facilities, and transportation networks. The growing requirement for reliable electrical systems, large-scale cabling, and modern energy infrastructure is boosting copper consumption across public and industrial projects. This expansion reflects the rising global focus on sustainable and resilient infrastructure development.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

What Makes Asia Pacific the Powerhouse of the Copper Products Industry?

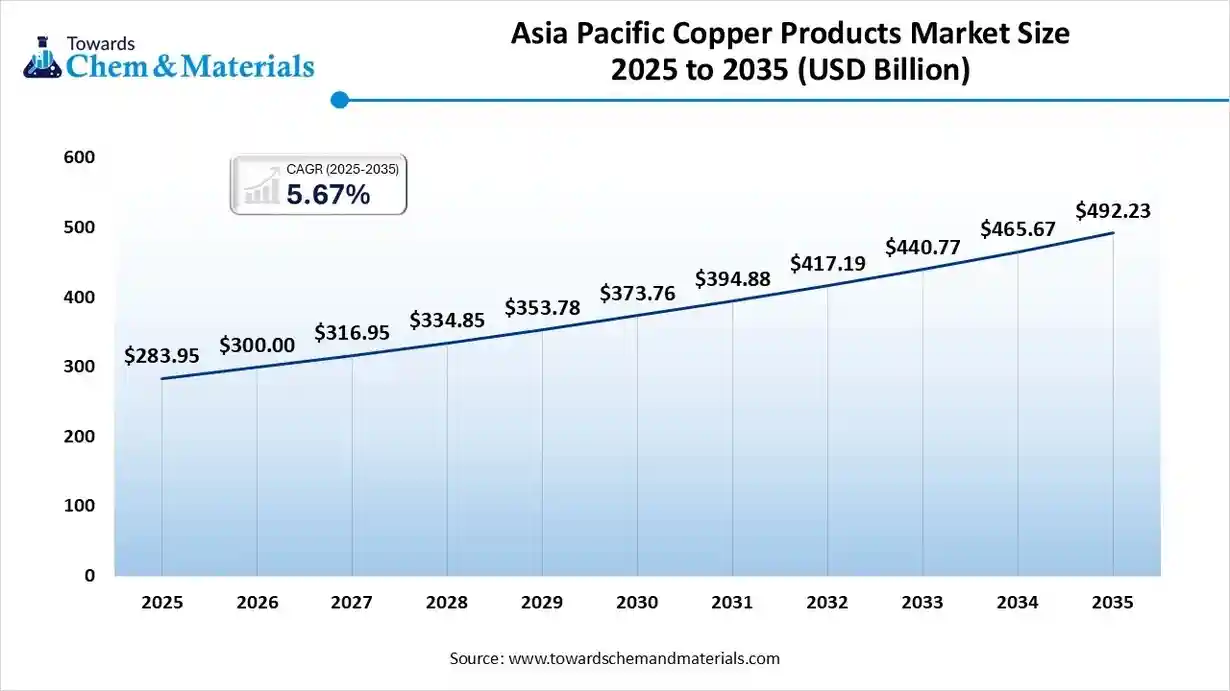

The Asia Pacific copper products market size was estimated at USD 283.95 billion in 2025 and is projected to reach USD 492.23 billion by 2035, growing at a CAGR of 5.67% from 2026 to 2035. Asia Pacific dominated the market with a share of 75.55% in 2025.

Asia Pacific dominated the market in 2024, sustained by widespread industrialisation, rapid urbanisation, and large-scale infrastructure and energy projects across the region. Extensive demand comes from construction, electronics, power transmission, and EV-related infrastructure, driving widespread use of copper in wiring, cables, foils, and other products. Robust manufacturing bases in countries throughout the Asia Pacific, building on copper’s electrical and thermal conductivity, anchor the region’s ongoing consumption surge.

China & India Copper Products Market Trends

Countries like China and India are central to copper demand within the Asia Pacific, driven by large-scale urban development, expansion of manufacturing and electronics industries, and large growing investment in renewable energy and electric vehicle infrastructure. China’s extensive refining and downstream manufacturing capacity supports heavy consumption for power grids, cables, and industrial applications. Meanwhile, India’s infrastructure builds out, rising electrification needs, and growing adoption of renewables and EVs are boosting copper usage across construction, wiring and energy projects.

North America Copper Products Market

The copper Products market in North America is experiencing robust growth, driven by significant investments in renewable energy and EV infrastructure. The U.S. and Canada have been heavily investing in renewable energy projects, such as wind turbines and solar panels, where copper's efficiency in energy transfer significantly reduces wastage, making it a preferred material for sustainable energy technologies. Government initiatives have further bolstered the copper industry. The Inflation Reduction Act has spurred investments in solar, wind, and battery storage projects, contributing to the market growth in the U.S.

U.S. Copper Market

The copper Products market in the U.S. accounted for the largest market revenue share in North America in 2024. The U.S. Department of Energy reported a 14% increase in renewable energy investments, leading to heightened demand for copper-based components in solar panels, wind turbines, and energy storage systems. Simultaneously, the surge in EV production amplified the need for copper Products in batteries and charging systems, prompting companies to expand their production capacities to meet this rising demand.

What’s Driving Europe to Grow Fast in the Copper Products Industry?

Europe is expanding quickly in the market due to rising demand for renewable energy systems, electrification of transport and infrastructure, and a push toward sustainable sourcing and recycling. In addition, growth in advanced manufacturing, electronics, and upgrades to power grids across the region is fuelling increased copper consumption for wiring, components, and speciality alloys.

Germany Copper Products Market Trends

Germany stands out in Europe’s copper market thanks to its strong industrial and automotive sectors, high demand for electrical and machinery components, and policies supporting energy transition and clean tech manufacturing. Its robust recycling infrastructure and emphasis on high-quality copper alloys and precision products further reinforce its dominant role in copper demand in Europe.

Latin America Copper Market Trends

The copper Products market in Latin America experienced notable growth, driven by its substantial mining capacity and increasing global demand for copper-intensive technologies. The region accounted for approximately 46% of the world's raw copper production, with Chile and Peru leading as top producers. Major mining operations, such as the Escondida mine in Chile, the world's largest copper mine with an annual capacity of approximately 1.4 million metric tons, played a pivotal role in meeting global copper demand. Countries like Mexico and Argentina have also been expanding their mining activities to capitalize on the growing demand.

Middle East & Africa Copper Products Market Trends

The copper Products market in the Middle East & Africa is anticipated to grow at a substantial CAGR during the forecast period. In the Middle East, countries like Saudi Arabia, the UAE, and Oman are investing in copper-intensive projects to diversify their economies beyond oil. Saudi Arabia's Vision 2035 emphasizes mining, including copper, as a key sector. The UAE and Oman are developing metal trading hubs to capitalize on the growing copper Products and other critical minerals demand.

More Insights in Towards Chemical and Materials:

- Copper Market Volume to Hit 38.86 Million Tons by 2034

- Copper Wire Market Size to Hit USD 284.70 Billion by 2034

- Copper Foil Market Volume to Hit 770.50 Kilo Tons by 2034

- Corrugated Plastic Sheets Market Size to Reach USD 3.05 Bn by 2034

- Polyolefin Sheets in Industrial Market Size to Hit USD 14.99 Bn by 2034

- TPE Films and Sheets Market Size to Hit USD 6.57 Billion by 2034

- U.S. Steel Rebar Market Size to Exceed USD 11.59 Billion by 2034

- Asia Pacific Steel Rebar Market Size to Surpass USD 248.88 Bn by 2034

- Steel Rebar Market Size to Reach USD 426.51 Billion by 2034

- Hot Rolled Coil (HRC) Steel Market Size to Reach USD 621.65 Billion by 2034

- Steel Rebar Market Size to Reach USD 426.51 Billion by 2034

- Structural Steel Market Size to Reach USD 188.63 Billion by 2034

- Stainless Steel Market Size to Surge USD 357.28 Billion by 2034

- Flat Steel Market Prices, News, Monitor, Market Analysis & Demand

- Copper Scrap Market Size to Surge USD 148.57 Billion by 2034

- Asia-Pacific Copper Market Size to Reach USD 344.08 Bn by 2034

- Europe Copper Market Size to Reach USD 84.16 Billion by 2034

Copper Products Market Top Key Companies:

- AngloAmerican

- Antofagasta plc.

- Aurubis AG

- BHP

- Codelco

- Freeport-McMoRan

- Glencore

- GRUPO MÉXICO

- Jiangxi Copper Corporation

- KGHM

- Rio Tinto

- Teck Resources Limited

Recent Development

- In October 2025, recent disruptions in mine output have highlighted risks to copper supply, prompting renewed commitment from major producers to keep large copper mining projects active so as to meet growing global demand, intensifying pressure on supply chains.

- In April 2025, India's Adani Enterprises Ltd is set to launch the world's largest copper smelter by June 2025. The upcoming smelter launch represents the project's first phase, with plans for capacity expansion already approved by environmental authorities. This development positions Adani Enterprises as a key player in the global metals sector, enhancing India's copper production and processing footprint.

- In April 2024, Prysmian, a global leader in energy and telecom cable systems, signed a long-term contract with Aurubis, the largest copper recycler and a leading European manufacturer of copper wire rods, to supply significant and progressively increasing volumes of copper wire rods. This agreement primarily supports Prysmian's European plants, ensuring supply continuity for current operations and future growth.

- August 2024 : Mueller Industries acquired Elkhart Products Corporation (EPC), a US-based copper solder fittings manufacturer, with facilities in Elkhart, Indiana, and Fayetteville, Arkansas. EPC was earlier owned by Dutch company Aalberts N.V. This acquisition strengthened Mueller's position to supply various industries, like plumbing, HVAC, automotive, and aerospace.

- July 2023 : n Wieland Group acquired Farmers Copper Ltd., a top copper, brass, and bronze alloy supplier in North America to strengthen its presence in the region. Through this acquisition, the company solidified Wieland's significant footprint and extensive market involvement in North America.

- March 2023 : n Wieland introduced cuprolife, a newly developed copper tube produced from 100% recycled copper, representing an important milestone towards sustainable and circular building. With cuprolife, Wieland develops building technology by combining fully recycled materials without any loss of performance or quality.

Copper Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Copper Products Market

By Type

- Primary Copper

- Secondary Copper

By Product

- Bars

- Rods

- Wires

- Strips

- Tubes & pipes

- Foils

- Tapes

- Alloy products

- Others

By Application

- Conductive use

- Earthing

- Structural use

- Shielding

- Others

By End-Use Industry

- Electrical & power transmission

- Metallurgy & foundry

- Industrial equipment & machinery

- Electronics

- Transportation

- Building & construction

- Power generation

- Plumbing

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6034

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/