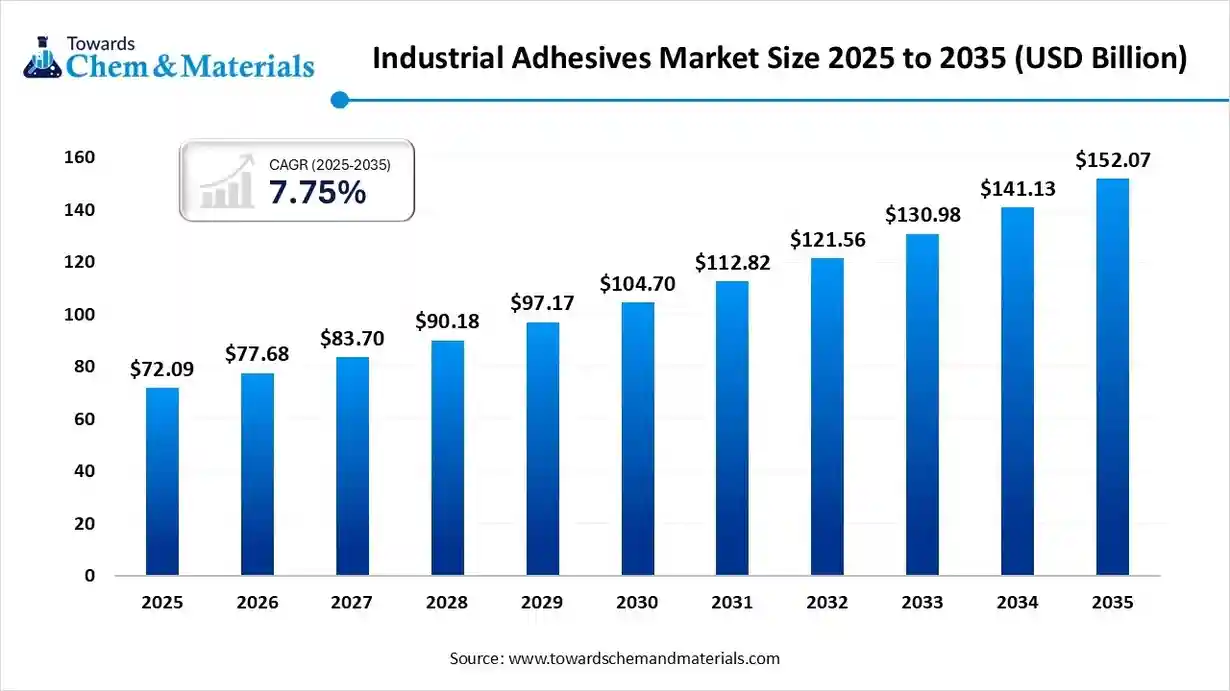

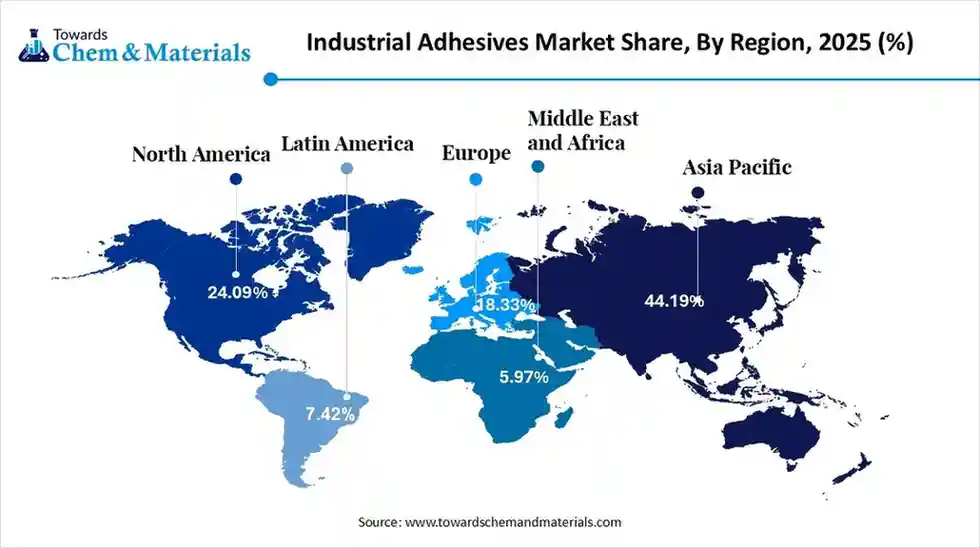

Ottawa, Jan. 08, 2026 (GLOBE NEWSWIRE) -- The global industrial adhesives market size was estimated at USD 72.09 billion in 2025 and is expected to increase from USD 77.68 billion in 2026 to USD 152.07 billion by 2035, growing at a CAGR of 7.75% from 2026 to 2035. Asia Pacific dominated the Industrial Adhesives market with the largest revenue share of 44.19% in 2025. A study published by Towards Chemical and Materials a sister firm of Precedence Research. The demand is driven by the need for lightweight manufacturing and high-performance materials. The development of bio-based adhesives and sustainable products is also transforming the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6090

Private Industry Investments for Industrial Adhesives:

- Anabond Limited is an Indian producer of high-quality coatings, sealants, and adhesives for the automotive, electrical, and construction sectors that has received private equity funding.

- Dymax Corporation is a global manufacturer of light-curable adhesives and coatings that provide rapid curing and high bond strength for industries such as electronics and medical devices.

- Resinova Chemie Ltd offers a diverse range of adhesives and sealants for construction, woodworking, and general bonding applications and was acquired by Astral Adhesives in 2014.

- Soudal India Private Limited is an Indian subsidiary of the global Soudal group, which specializes in sealants, adhesives, and polyurethane foams for construction and industrial applications.

- Visen Industries is a company specializing in water-based adhesives (emulsions) that is a portfolio company of the private equity firm The Carlyle Group.

What Are the Major Trends in the Industrial Adhesives Market?

- Sustainability Focus: To meet regulatory requirements, manufacturers are increasingly implementing eco-friendly formulations, and Consumer choices for green products. Strict environmental regulations are reshaping the adhesives market and the adoption of renewable energy that minimizes environmental impact while balancing performance.

- Industrial Application: The expanding packaging and Automotive industry is significantly driving the market growth by enhancing performance and improving corrosion resistance. Regulatory standards are pushing manufacturers toward lightweight materials and efficient bonding solutions to improve fuel efficiency and lower emissions.

- Surging Demand in Emerging Economies: The market tends to grow due to increasing urbanization and rapid industrialization in global regions that intensify competitive positioning in the eco-friendly marketplace.

- Increase in Investment and Collaboration: Increased investments in manufacturing driven by rising demand for eco-friendly products, pushing research towards innovative formulation and advanced production technologies that are fueling the number of players in the market. Strategic partnerships are driving a lot of recent innovation and helping to boost market readiness for new adhesive products.

How is Technology Integration Driving Performance and Efficiency in End-Use

Artificial Intelligence (AI) practices are utilized to forecast optimal bonding outcomes, complemented by Internet of Things (IoT)-enabled sensors for real-time quality monitoring, thereby reducing adhesive waste. Technological integration supports quality control and predicts coating performance by applying machine learning algorithms. Advanced formulations emphasize electrical insulation and potting solutions to safeguard high-voltage electronics from environmental factors such as moisture, dust, and electrical arcing. Digital technology and intelligent systems are employed to optimize energy production, transmission, and consumption.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6090

Industrial Adhesives Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 77.68 Billion |

| Revenue forecast in 2033 | USD 152.07 Billion |

| Growth rate | CAGR of 7.75% from 2026 to 2035 |

| Actual data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2035 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product, By Application, By Region |

| Regional scope | North America; Europe; Asia Pacific; MEA; Latin America |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Saudi Arabia; South Africa; Brazil; Argentina |

| Key companies profiled | Henkel AG & Co. KGaA, 3M Company, Arkema Group, Sika AG, Huntsman Corporation, Dow Inc., BASF SE, Ashland Global Holdings Inc., DuPont de Nemours, Inc, H.B. Fuller Company |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are Industrial Adhesives Made Out Of?

Industrial adhesives are made up of a range of organic compounds that are combined in specific formulations to produce adhesives with a variety of properties. These properties can range from water-based adhesives to polyolefins, ethylene-vinyl acetate (EVA), polyurethanes, and more.

- Water-based adhesives are made from a mixture of water-soluble polymers and other organic compounds. They are commonly used in industries where low toxicity and easy clean-up are important, such as in the paper and packaging industry.

- Polyolefins, such as polyethylene and polypropylene, are another type of industrial adhesive that is commonly used in the packaging industry. They are made from polymers derived from hydrocarbons and are known for their excellent adhesion to a wide range of substrates.

- Ethylene-vinyl acetate (EVA) is a type of industrial adhesive that is used in a range of industries, including footwear, packaging, and automotive. EVA is made from a copolymer of ethylene and vinyl acetate and is known for its flexibility and toughness.

- Polyurethanes are another type of industrial adhesive that is commonly used in industries such as construction, automotive, and electronics. They are made from polyols and diisocyanates and offer excellent adhesion to a wide range of substrates, as well as resistance to water and chemicals.

Types of Industrial Adhesives

Industrial adhesives can be categorized in a number of different ways, but typically by chemical composition (as in acrylic adhesives) or by adhesion properties (e.g., hot melt adhesives).

- Chemical Composition

- The types of industrial adhesives and sealants found in the Engineering360 SpecSearch database include acrylics and cyanoacrylates; epoxy adhesives; phenolic, melamine and urea formaldehyde resins; and polyurethane adhesives. Rubber and silicone products are also available from many different suppliers.

- Acrylic adhesives are known for their excellent environmental resistance and fast-setting times when compared to other resin systems. Cyanoacrylates, or super-glues, are one-part acrylate adhesives that cure instantly on contact with mated surfaces through a reaction with surface moisture.

- Epoxy adhesives are chemical compounds for joining components. A copolymer, epoxy is formed from two different chemicals: a resin and a hardener.

- Phenolic, melamine, and formaldehyde resins are thermosetting adhesives that form strong bonds and have good resistance to high temperatures. As thermoset materials, they require heat or heat and pressure to cure and to form a secure bond.

- Polyurethane adhesives provide excellent flexibility, impact resistance, and durability. They are often used in finish carpentry and with woodworking projects.

- Rubber adhesives and sealants provide highly flexible bonds and are usually based on butadiene-styrene, butyl, polyisobutylene, or nitrile compounds.

- Silicone adhesives and sealants have a high degree of flexibility and very high temperature resistance. They are used in plumbing as well as in marine applications.

Market Opportunity

How are Adhesives Transforming the Development of Electrification and E-mobility?

Structural adhesives are increasingly substituting traditional welding and riveting techniques, facilitating critical vehicle lightweighting and enhancing thermal management through the use of thermal interface materials (TIMs). The demand for materials such as epoxies and silicones is notably high, particularly for high-performance battery encapsulation and as thermal interface materials within electric vehicles. This transformation facilitates the circular economy.

How do Water-Based Adhesives help Market Players to Achieve their Sustainability Goals?

The development of water-based adhesive formulations that address environmental compliance, sustainability mandates, and low volatile organic compound (VOC) requirements enables premium market positioning while decreasing reliance on solvent-based platforms. These adhesives are essential to packaging, woodworking, and paper industries, especially where environmental certifications are required.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6090

Industrial Adhesives Market Segmentation Insights

Product Insights

How did the Acrylic Segment hold the Largest Share of the Industrial Adhesives Market?

The acrylic product segment held the largest share of the market, driven by advanced chemical formulations featuring optimized polymer chemistry and robust chemical bonding characteristics, which include high adhesion strength, thermal stability, rapid curing capabilities, and UV resistance that enable manufacturers to attain superior component bonding. These formulations are compatible with automated dispensing systems, making them the preferred choice for high-throughput assembly environments and production operations.

The polyvinyl acetate segment is projected to expand fastest as it has strong temperature resistance. Polyvinyl alcohol (PVA) adhesives, known for their enhanced bonding strength and creep resistance, are utilized extensively in the furniture and packaging industries. The movement towards eco-friendly formulations, environmental compatibility, and innovations in polyvinyl acetate emulsions is driving this momentum. The development of bio-based PVA adhesives derived from renewable resources supports sustainable practices and aligns with global decarbonization objectives.

Application Insights:

How the Packaging Segment Dominates the Industrial Adhesives Market in 2025?

The packaging segment shows the biggest market share in 2025. The packaging industry is increasingly adopting sustainable packaging solutions, driven by rising e-commerce activity and increased demand for flexible food packaging. Adhesives are crucial for sealing, labelling, and lamination processes, with acrylic and polyvinyl acetate adhesives being predominantly used. Future growth in packaging infrastructure and the need for secure, environmentally friendly packaging for ready-to-eat foods are expected to boost bio-based adhesive applications.

The automotive segment is anticipated to grow fastest as demand rises due to adhesives being increasingly replaced by traditional welding and mechanical fasteners, particularly in the manufacture of light vehicles, electric vehicles (EVs), and low-emission automobiles. Investment in innovative, high-performance adhesive products, along with their integration into automated assembly systems, enhances production efficiency and quality assurance. The electrification initiatives further increase the demand for automotive adhesives, particularly to serve as mechanical fasteners in battery protection and other critical components.

Regional Insights

How did Asia Pacific Dominate the Industrial Adhesives Market?

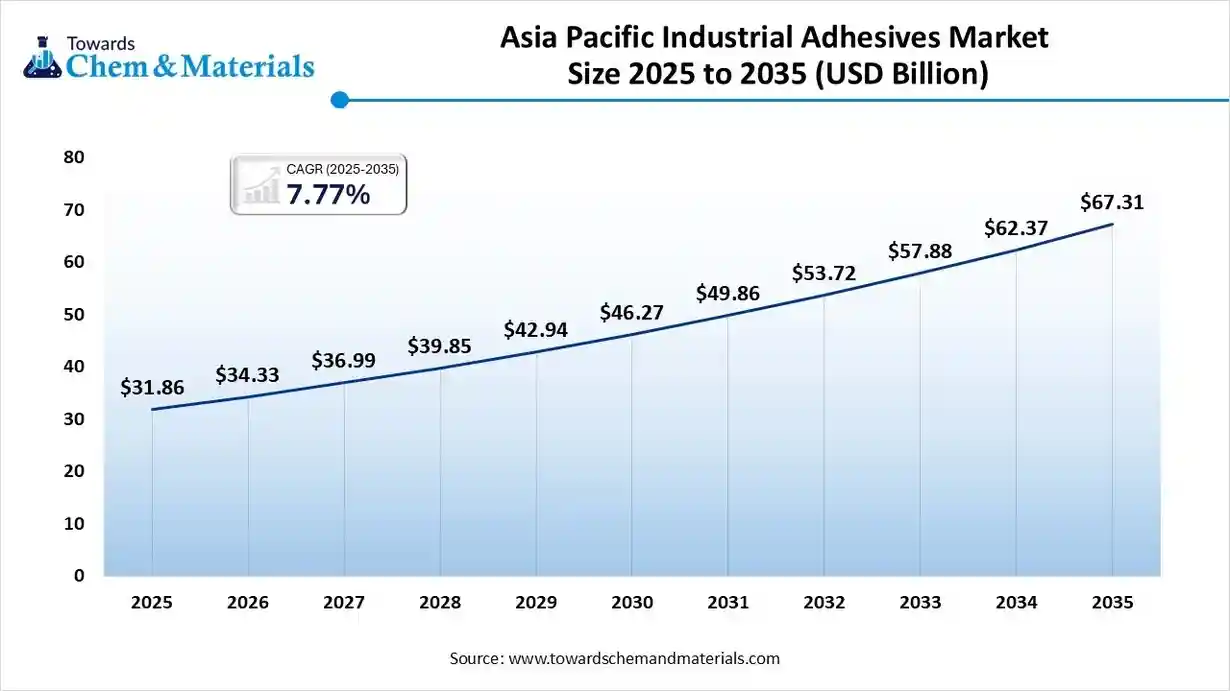

The Asia Pacific industrial adhesives market size was valued at USD 31.86 billion in 2025 and is expected to reach USD 67.31 billion by 2035, growing at a CAGR of 7.77% from 2026 to 2035.

The Asia-Pacific region leads in market adoption, driven by expanding automotive manufacturing and packaging infrastructure development. The availability of competitive labour costs and access to key raw materials attract global manufacturing and export hubs. Increasing industrialization and manufacturing expansion in this region are further augmenting adhesive consumption.

The growing demand in the automotive sector is projected to increase in this region due to a surge in sales of passenger cars. Government manufacturing initiatives offer substantial support for domestic chemical technology advancements.

China Industrial Adhesives Market Trends

China’s market is experiencing robust growth, with the largest consumer base stemming from increased demand in construction, packaging, automotive, and electronics sectors. The strong domestic demand is driving market development. The shift towards eco-friendly adhesives and the growing demand for lightweight materials are propelling smart manufacturing and automation, thereby elevating the necessity for high-performance adhesives.

Why is North America the Fastest-growing Region in the Industrial Adhesives Industry?

The North America region holds an expanding position in the markets that exhibit moderate growth, primarily driven by applications within the construction industry, expansion in the healthcare sector, and trends in the integration of e-commerce packaging technology. Developments such as smart adhesives and nanotechnology enhance product strength, durability, and precision, while improving resistance to environmental conditions. Consumer preferences are increasingly oriented towards sustainable and durable products, as well as mobility solutions. Furthermore, innovations in lighting and fuel efficiency within the automotive sector promote continued advancement.

U.S. Industrial Adhesives Market Trends

The U.S. serves as a prominent example due to its well-established automotive, aerospace, construction, and electronics industries. The demand for high-performance adhesives is driven by ongoing innovations in lightweighting and fuel efficiency, the need for sustainability platforms compliant with environmental regulations, and the criteria used in procurement decision-making. The key market players invest in local as well as global R&D infrastructure, fueling the growth.

More Insights in Towards Chemical and Materials:

- Europe Adhesives and Sealants Market Size to Surpass USD 34.62 Bn by 2035

- Europe Construction Adhesives and Sealants Market Size to Surpass USD 9.39 Bn by 2035

- Asia Pacific Adhesives and Sealants Market Size to Surpass USD 59.50 Bn by 2035

- North America Adhesives And Sealants Market Size to Hit USD 27.50 Bn by 2035

- Aerospace Adhesives and Sealants Market Size to Hit USD 3.66 Bn by 2035

- Bonding Adhesives Market Size to Hit USD 42.42 Billion by 2035

- Tile Adhesives Market Size to Hit USD 7.61 Billion by 2034

- U.S. Adhesives and Sealants Market Size to Surge USD 17.08 Billion by 2034

- Polyester Hot Melt Adhesives (PHMAs) Market Size to Hit USD 1,491.92 Million by 2034

- Biobased Adhesives Market Size to Reach USD 14.66 Billion by 2034

- Adhesives and Sealants Market Size to Surpass USD 139.79 Bn by 2035

- Adhesives Market Size to Hit USD 124.77 Billion by 2034

- Rubber-repair Adhesives Market Size to Reach USD 2.08 Bn by 2034

- Liquid Adhesives Market to Boom USD 58.60 Bn at 3.35% CAGR

- Plastic Adhesives Market Size to Hit USD 15.55 Billion by 2035

- Electronic Adhesives Market Size to Reach USD 6.32 Bn in 2025

- Water Based Adhesives Market Size to Reach USD 42.42 Billion in 2025

- Floor Adhesives Market Size to Reach USD 10.25 Billion in 2025

- Europe Adhesives and Sealants Market Size to Surpass USD 34.62 Bn by 2035

- Europe Construction Adhesives and Sealants Market Size to Surpass USD 9.39 Bn by 2035

- Asia Pacific Adhesives and Sealants Market Size to Surpass USD 59.50 Bn by 2035

- North America Adhesives And Sealants Market Size to Hit USD 27.50 Bn by 2035

- Aerospace Adhesives and Sealants Market Size to Hit USD 3.66 Bn by 2035

- U.S. Adhesives and Sealants Market Size to Surge USD 17.08 Billion by 2034

- Adhesives and Sealants Market Size to Surpass USD 139.79 Bn by 2035

Top Companies in the Industrial Adhesives Market & Their Offerings:

- 3M Company: Supplies high-strength structural adhesives and VHB tapes for permanent bonding in electronics and manufacturing.

- Dow Inc.: Specializes in silicone-based sealants and adhesives for thermal management and weatherproofing in harsh environments.

- Huntsman Corporation: Provides heavy-duty epoxy and polyurethane adhesives under the Araldite brand for aerospace and automotive structural assembly.

- Arkema Group: Offers advanced hot-melt and specialty bonding solutions through its Bostik subsidiary for the packaging and hygiene markets.

- Sika AG: Delivers high-performance elastic bonding and sealing systems for the global construction and automotive sectors.

- BASF SE: Produces sustainable adhesive raw materials and dispersions used in labels, flexible packaging, and woodworking.

- Ashland Global Holdings Inc.: Manufactures pressure-sensitive and structural adhesives for high-performance labeling and transportation assembly.

- Henkel AG & Co. KGaA: Leads the market with Loctite engineering adhesives for instant bonding, threadlocking, and structural repairs.

- DuPont de Nemours, Inc: Supplies BETAMATE structural adhesives specifically engineered for crash-durability and lightweighting in vehicle manufacturing.

- H.B. Fuller Company: Focuses on diverse adhesive chemistries including hot-melts and polymers for packaging and hygiene applications.

What is Going on Around the Industrial Adhesives Industry?

- In May 2025, Henkel and Sasol came into a strategic partnership to make low-carbon advanced adhesive solutions. Sasol's technology to reduce CO2 emissions is aligned with Henkel's adhesive value chain, which reflects a commitment towards sustainability goals.

- In December 2024, Bostik, the adhesive solutions segment of Arkema, acquired Dow's product offering, a high-performance technological innovation for the flexible packaging laminating adhesive business in food, medical, and other industries.

Industrial Adhesives Market Top Key Companies:

- Henkel AG & Co. KGaA

- 3M Company

- Arkema Group

- Sika AG

- Huntsman Corporation

- Dow Inc.

- BASF SE

- Ashland Global Holdings Inc.

- DuPont de Nemours, Inc

- H.B. Fuller Company

Industrial Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Industrial Adhesives Market

By Product

- Acrylic

- Polyvinyl acetate

- Epoxy

- Polyurethane

- Ethyl vinyl acetate

- Others

By Application

- Automotive

- Packaging

- Electrical & electronics

- Medical

- Industrial machinery

- Furniture

- Footwear

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6090

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/